Market Update – Coronavirus and Oil

Given the large and sudden deterioration in share markets globally in the last week, I wanted to put some perspective on things. The very sharp falls in the last 2 days are a result of the continued march of Covid_19 and Russia and the OPEC producing oil nations not being able to agree to curb production.

However, a large reason for the falls yesterday and overnight was also due to computers (read algorithms) trading the market and those with Margin Loans being forced to sell as the value of their portfolio’s fall close to what they borrowed. So it wasn’t (for the most part) investors. To put some numbers around what happened in last few weeks;

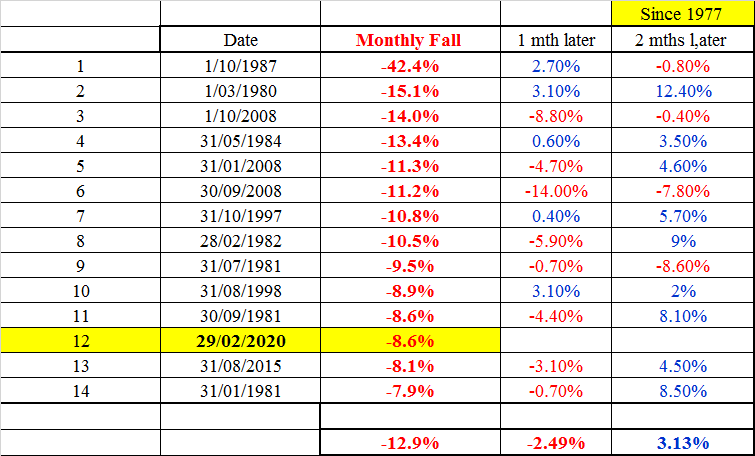

The February fall of -8.6% in the All Ords was the 12 biggest in the last 43 years.

- In the last 43 years we have had 13 previous times where All Ords dropped -7.9% or more in a single month.

- Now 6 of these 13 times it was down again the following month (and 3 times both the 2 following months).

- But the fall the first month was -12.9% – but the following month we saw the All Ords on average down another -2.49%. The reason being that markets re-tests its lows & after such a big fall as the panic sellers continue to sell the rallies.

- Then the 2nd month – after the lows are held – it’s been higher 9 times or 70% of the time, with an average gain of +3.13%.

Source Coppo report (Bell Potter)

What this does show is that prices fall and prices rise. The issue is the timing is impossible to predict. If Russia & Saudi both came to an agreement, the oil price would recover a lot of lost ground & all these problems would disappear, as quickly as they emerged. So markets will hope that Russia takes the Saudi’s aggressive oil war manoeuvres on the weekend & comes back to the table this week.

The below is a good article (US based) that reinforces we are INVESTORS, not traders. At Murphy Hill we don’t believe in buying the 3 letter ASX code but actual businesses. So we are looking at profitability, what they produce or provide, debt levels, quality of management and the like. Corona Virus and the Oil price are short term issues for us to contend with. In our view, they are not long term issues.

As the CIO of AustralianSuper said this morning (I am summarising a long article);

“Investors need to ask themselves three questions – How big the coronavirus could become?, What will the economic impact be? and How will the market react to those economic ramifications?” To the first question, NO one knows at this stage. To the Second question, the OECD say that globally it will result in a 1.5% drop in global growth (yes that’s correct ,1.5%), although several countries like Japan, South Korea could fall into recession. To the third AustralianSuper are of the view that the effect on global growth will be sharp but short. It is clearly going to push global growth lower. If it’s a severe but temporary phenomenon, the impact on profits won’t be large and of course reserve banks and Governments are going to do everything they can to stimulate economies.

Lastly, please keep in mind when you get your information from the media, be careful what you are reading. I saw an article in the Financial Review last night quoting Bill Evens (Chief Economist for Westpac since 1991) with a headline of Chief Economist says Australia heading for Recession. So you click on the article and he says (and I quote);

“On a quarterly basis we expect the economy will contract in both the first and second quarters by 0.3 per cent and 0.3 per cent respectively to be followed by a rebound of 1.4 per cent and 0.8 per cent respectively in the third and fourth quarters,” Westpac chief economist Bill Evans wrote.

“That growth profile constitutes a technical recession but given the expected recovery in the second half of the year it is much more realistic to characterise the situation as a ‘major disruption’ to growth rather than the style of recession that Australia has experienced in the past.”

The article also quotes CommSec chief economist Craig James predicting petrol prices could also drop dramatically.

“The ready-reckoner is that every US$1 a barrel fall in the oil price leads to a 1.0 cent fall at the petrol bowser. Provided the Aussie dollar is reasonably stable, motorists may be able to look forward to filling up for near $1 a litre,” he wrote in a research note.

Fuel prices in Australia’s capital cities on Sunday ranged from an average of $1.19 a litre in Adelaide to $1.536 in Hobart, according to Motormouth.com.au.

In Sydney, petrol was selling for $1.248, while it cost an average of $1.239 in Melbourne.

This is a good thing for an economy, especially one in the middle of the biggest Infrastructure build we have ever gone through, not to mention the re-build following the bush fires. This means it is cheaper to fill up for you and I but also cheaper for heavy machinery, trucks distributing goods, planes and the like.

To finish off, the best piece of advice I can give at this juncture is to ask yourself what your financial goals and objectives are in the next few years and focus on these. It also helps to STOP updating what your portfolio value constantly. In times like these, we know it’s going to be down. However, it’s only crystalized once you sell. If I told you your house was down in value last year by some 7-10% (which it was), would you have sold? No. You would say, not important as I am a long term investor in property and it will eventually come back to value (which it has!). The same logic needs to be applied to share based investments.