Autumn 2023

With Autumn underway, the changing season is a reminder to take stock and prepare for what’s ahead as the financial year heads towards its final quarter and the May Federal Budget.

Many of you will be wondering what we think about the just announced ‘changes’ to superannuation by the Labor Government. In short, it’s way too early to know as we’ve been given very little detail. For example, is it just earnings, or would it alter the CGT payable in superannuation as well? What happens on death of a partner? etc… In short, it looks to me like this has been thought up in the last few days to stop the media asking various ministers what they will and won’t do. What we do know is that it won’t come into play until the next election. So they need to be voted in for it to be real.

The gloomy prospects for economic growth, both in Australia and overseas, are occupying the minds of investors, businesses and political leaders.

The Reserve Bank of Australia believes global growth will remain subdued for the next two years and that Australia‘s economy will slow this year because of rising interest rates, the higher cost of living and declining real wealth. The RBA forecasts the unemployment rate, currently at a low 3.5%, to rise by mid year and inflation, which was 7.8% over 2022, to drop to by around 2-3% over coming years thanks to an easing in global prices that will eventually flow through to Australian prices. Oil prices fell almost 3% in February reversing the increase of the previous month.

There have been some economic bright spots recently such as the rebound in retail trade in January of 1.9% after a 4% plummet in sales figures in December. And, Australia‘s current account surplus increased $13.3 billion to $14.1 billion in the December quarter 2022 supported by sustained high commodity prices including $400 billion worth of mining commodity exports during 2022.

That positive news was enough to lift the Australian dollar slightly to just over US67c, halting a slow decline during February.

Australian shares were down by almost 3% during February, while US stocks were down by just over 2% for the month and more than 7% for the past year.

Flexing your retirement plans

The concept of retirement is changing, with fewer people working towards a final retirement date and then clocking off for good.

Instead, those who have the flexibility to choose are often transitioning out of the workforce over several years, or even returning after a break.

Whether you simply want to wind back your working hours to explore other interests, or don’t want to cut your ties with work completely, to make it work you need to plan.

Choosing your retirement date

There is no set retirement age in Australia, but most people will not be eligible to receive an Age Pension until they reach age 67.i This means you need enough savings to provide another income source if you retire earlier.

Although most of us have super, you are not permitted to access it until you reach your preservation age, which can vary.

Withdrawing your super also requires you to meet a condition of release. There are various conditions, but the most common one is reaching age 60 and permanently retiring from the workforce. Once you turn 65, you can access your super whether you are working or not.ii

Keep in mind, tax also affects your super, with different rates applying depending on your age. Most people can access their super tax-free once they reach 60.

Paying for your retirement

Unfortunately, there is no simple answer to how much income you will need in retirement. It depends on your current lifestyle and planned retirement activities, but a good place to start is the ASFA Retirement Standard.

For around 62% of the population aged 65 and over, the main source of retirement income is the Age Pension and government payments.iii

Eligibility for an Age Pension is assessed using your age, residency status and personal income and assets. These determine whether you receive the full fortnightly payment rate, which is currently $1,547.60 a fortnight for a couple.iv

As part of your planning, check for other potential sources of income from investment assets, contract work, or rent from investment or Airbnb properties.

Using your super savings

While you may dream of retiring early, many of today’s retirees can expect to live well into their 80s, so your super may need to provide income for more than 20 years. If you are unsure whether your super is on track, we can help you check your progress and put strategies in place to achieve your retirement goals.

Most super funds provide online calculators to give a rough estimate of your likely retirement balance and how much income it will provide.

ASIC’s MoneySmart Retirement Planner is another resource for working out your retirement income and potential Age Pension payments.

Transition-to-retirement (TTR) pensions

If you would like to ease into retirement, it can be worth investigating a TTR pension. These allow you to cut back working hours while using your super to supplement your income without compromising your lifestyle.

If you are aged under 60 you will pay some tax on pension payments, but they are tax-free once you reach age 60.v

TTR pensions also allow you to continue topping up your super through a salary sacrifice arrangement with your employer. You only pay 15% tax on these contributions, which may be lower than your marginal tax rate.v

Giving super a late boost

If you have income to spare as you move towards retirement, perhaps from an inheritance or downsizing your home, there are now additional opportunities to continue adding to your super.

You can make personal after-tax contributions of up to $110,000 a year until you reach age 75, even if you are not working. You may even be eligible to use a bring-forward arrangement and add up to $330,000 in a single year.

Once you hit 60, if are planning to sell your current home you can also make a downsizer contribution of up to $300,000 ($600,000 for a couple) into your super account.

Retiree concessions

When you are doing your retirement sums, don’t forget some of the concessions on offer to older Australians. If you are aged 60 and over and working less than 20 hours per week, your state’s Seniors Card can provide discounts on public transport and some goods and services.

You may also be eligible for the Commonwealth Seniors Health Card for cheaper prescriptions and medical appointments, or a Pensioners Concession Card for discounted public transport.

If you would like to discuss your retirement options and how to fund them, give us a call.

i https://www.servicesaustralia.gov.au/who-can-get-age-pension?context=22526

ii https://www.ato.gov.au/Individuals/Super/

iii https://www.aihw.gov.au/reports/australias-welfare/age-pension

iv https://www.servicesaustralia.gov.au/how-much-age-pension-you-can-get?context=22526

v https://moneysmart.gov.au/retirement-income/transition-to-retirement

Star ratings for Aged Care help make family choices easier

Moving into aged care can be a challenging time, both for those making the move and families supporting their loved ones. It’s understandable that everyone wants to find the most suitable accommodation and the appropriate standard of care, however, it can be confusing to make that choice.

A new star rating system for aged care is giving existing and potential residents and their families helpful insight into the quality and staffing levels of an aged care facility.

Four key performance areas covering residents’ experience, staffing levels, compliance and quality measures are each given an individual star rating. These ratings are then combined to provide an overall rating which is made public on the My Aged Care website.

For many people this will be the most consistent measure of whether aged care accommodation meets independent requirements for a good, average or poor facility.

A one-star rating indicates significant improvement needed; two stars indicates improvement needed; three stars indicates an acceptable quality of care; four stars indicates a good quality of care and a five star rating indicates an excellent quality of care.

There has been one round of ratings revealed since the system was launched in December 2022, with about one-third of the 2,700 aged care facilities in Australia receiving four or five stars, two thirds receiving three stars and one-in-10 receiving one or two stars.

How care is measured

Staffing levels in aged care are always of interest. With no staff ratios in aged care, the focus is on ‘care minutes’ provided by registered nurses, enrolled nurses and personal care workers.

A new funding model – in place from 1 October 2022- requires aged care facilities to meet a minimum average care minute target of 200 minutes a day, including 40 minutes registered nurse time. This target will become mandatory from 1 October 2023, and increase to 215 minutes, including 44 registered nurse minutes, from 1 October 2024.

Quality measures

The five crucial areas of care that go into determining the quality star rating include pressure injuries, physical restraint, unplanned weight loss, falls and major injury, and medication management.

The data is collected quarterly, with zero-star ratings given to providers who fail to report on each area.

The compliance rating, which is the responsibility of the existing Aged Care Quality and Safety Commission, provides information on the extent to which a residential aged care service is meeting its responsibilities.

A service that receives a one star compliance rating (which would occur if it was sanctioned or found to be punishing anyone who complained to the Commission) will receive an overall one star rating, regardless of how they perform in other sub-categories. Services that receive a two star compliance rating (if they were issued a compliance notice under the current system) cannot receive an overall star rating higher than two stars, regardless of how they perform in other sub-categories.

Resident experiences

A resident’s experience of a facility carries the highest weighting towards the overall star rating.

To understand the lived experience of residents, 12 questions are asked, for example – ‘do staff treat you with respect’, do you feel safe here’, ‘do you get the care you need’, and ‘are the staff kind and caring’. Responses can vary from never to always.

At least 10 per cent of older Australians living in residential aged care will be interviewed face-to-face about their overall experience at their residential aged care home by a third-party vendor each year.

Anyone currently living in or considering a facility with a low rating should feel empowered to ask what management is going to do about improving things.

Be informed

The star ratings are a recommendation of the Aged Care Royal Commission to better inform people living in or considering moving into residential aged care and to provide greater transparency in an effort to lift the overall standards.

They will become an increasingly important tool in the planning and decision-making process.

Give us a call to help you or a loved one plan for current and future needs.

Trust your gut to boost your health

Gut health has become one of the hottest health topics in recent years as we have started to learn about the complex connection between gut health and overall health. So why is gut health so important and how can we support and boost our own microbiomes?

Firstly, what exactly is a microbiome? The human microbiome consists of the trillions of fungi, bacteria, viruses, and other organisms harboured by each person, primarily in the gut. So prevalent are these critters, we are more microbiome than human. The approximately 30 trillion cells in an adult body are a little outnumbered by the around 39 trillion cells in the tiny organisms that comprise your microbiome.i

Not only are we outnumbered, we are also only just learning about the importance of our microbiome and how these trillions of bacteria and other microbes work together to affect functions as diverse as digestion, immunity, heart function, and even mental health.

Our guts do so much more than digest our food

For years, experts have suspected a connection between gut health and heart health. Recent research has found that changes in certain types of gut bacteria are associated with high blood pressure, lower levels of “good” cholesterol, heart disease and even events like heart attacks and strokes. Scientists currently think this has to do with the compounds gut bacteria produce when they break down certain foods. Having the wrong balance of bugs may mean more by-products which can raise cholesterol and injure blood vessels.

There is also a strong association between our immune system and gut health. It is estimated that 70-80% of the body’s immune system is in the gut, working to ensure that the body is eliminating any harmful pathogens that it encounters.ii

While we have long known that how we feel can affect our guts – think of ‘butterflies in our stomach’ when we are nervous or ‘gut wrenching’ when we hear bad news – but scientists are learning more about the complex connection between our gut biome and our mental health. For a long time, researchers thought anxiety and depression contributed to digestive issues, but studies are showing that irritation in the gastrointestinal system may send signals to the brain to trigger mood changes.

While we still have much to learn about how the gut impacts other parts of the body, growing evidence is pointing to the importance of looking after your gut biome – so how do we do that?

What is good for the gut?

If you pop ‘gut health’ into a search engine, you’ll be bewildered by the amount of information (and some disinformation!) available online. Here are a few science-backed things that we know support good gut health.iii

-

Eating a plant-based diet including a range of wholefoods with lots of soluble fibre (oats, seeds and certain fruit and veggies)

-

Incorporating fermented foods into your diet – think kimchi, miso, kombucha

-

Vitamin D – we don’t need a lot of outside time to keep up our vitamin D levels (and it’s important to be sun safe) but vitamin D has been proven to be an important part of gut health.

-

Water (hydration helps keep the gut healthy!)

-

Moving your body – the recommendation is 30-60 minutes of moderate exercise at least three days a week.

What to avoid?

And of course, it’s not just what we can do to promote good gut health, but also what we can avoid to help support a positive gut biome.

On that note, stress has been found to have a very detrimental impact on gut health as does too much fatty and processed foods. Too much sugar in your diet can also be a contributor to poor gut health and alcohol has also been shown to be a culprit when it comes to your gut.

You don’t have to overhaul your diet and lifestyle though – even small tweaks will help you support a happy and health gut biome and reap the benefits to your physical, and even mental health.

i https://www.sciencefocus.com/the-human-body/human-microbiome/

ii https://pubmed.ncbi.nlm.nih.gov/33803407/

iii https://www.vichealth.vic.gov.au/be-healthy/how-to-improve-your-gut-health

Hill Partners Pty Limited ABN 29 790 431 182 is an Authorised Representative of Oreana Financial Services Limited ABN 91 607 515 122, Australian Financial Services Licensee No. 482234. Registered Office Level 7, 484 St Kilda Road Melbourne, Victoria 3004 Australia General Advice Warning: https://www.oreanafinancial.com/general-advice-warning/

Privacy Policy: https://www.oreanafinancial.com/privacy-policy/

Welcome to 2023!

Welcome to 2023.

Let’s hope this year is less exciting than last.

Markets continue to adjust and try to anticipate what inflation is doing. So to, I might add are Central Banks (including ours). I note as of this morning, US inflation has come down again for the seventh month in a row. So it’s heading in the right direction.

My view is it’s likely this pattern will continue into this year. This should give reason to at least pause interest rate increases in the next 1-2 meetings. The issue for Central Banks is that most developed economies are still at full employment. I view this as a good thing as rising cost of living can at least be partly covered if you have a job!

The central banker however wants unemployment as it eventually means inflation goes lower and stays there. So there remains the possibility that US Fed, RBA, et al keeping rising regardless. I view this as a bad thing for economies and markets. However, I would say, low unemployment, healthy corporates (apart from it seems large private property developers), consumers wanting to move on with their lives following the pandemic and a world moving to electrification and decarbonisation (and Australia having most of the commodities required for this), should mean if we do have a recession, it won’t be as bad as say the GFC.

The good news is Central Banks are very data driven at present, so if inflation keeps coming down, then central banks will pause and markets will adjust.

We can talk more about this as the year progresses.

On the team front here at Murphy Hill, we have 2 new members in Tom Sturmann (Associate Adviser) and Shane (Shey) Labaya who is a Financial Planning Assistant. You will get the opportunity to meet then in some capacity when we next meet.

Wishing you all the best for this year.

Below is a short article from Dr Shane Oliver on recent RBA activity.

rba-oi-3-2023.pdf (amp.com.au)

Hill Partners Pty Limited ABN 29 790 431 182 is an Authorised Representative of Oreana Financial Services Limited ABN 91 607 515 122, Australian Financial Services Licensee No. 482234. Registered Office Level 7, 484 St Kilda Road Melbourne, Victoria 3004 Australia General Advice Warning: https://www.oreanafinancial.com/general-advice-warning/

Privacy Policy: https://www.oreanafinancial.com/privacy-policy/

October Federal Budget

The below Budget commentary is provided by NAB and in particular, Ms Gemma Dale (Director of SMSF and Investor Behaviour at nabtrade). More than happy to provide the long summary of the budget in terms of bigger picture impacts and all the announcements but the below is short and sweet and touches on some items I think that are relevant.

Welcome to our coverage of the Federal Budget, delivered by new Labor Treasurer Dr Jim Chalmers. Given the new government has only been in power a few months, the Budget is relatively light on personal impact, with no major reform predicted before the May Budget next year. There are, however, quite significant benefits for older Australians and those with young children, some changes for investors to be aware of, and several initiatives in health, housing and education.

Please note that all announcements are yet to be legislated.

Taxation

There are no major changes to the personal income tax rates or thresholds, nor to any existing rebates or credits.

Investors should be aware that the Government will align the tax treatment of off-market share buy-backs undertaken by listed public companies with the treatment of on-market share buy-backs. While this strategy has been used less than 50 times over the last fifteen years, it can offer very attractive tax treatment for some shareholders. This measure will apply from its announcement at7:30pm on Budget night. Companies will continue to be able to conduct on-market buybacks or pay franked dividends out of retained profits.

For those holding or trading cryptocurrency, the Government will introduce legislation to clarify that digital currencies (such as Bitcoin) continue to be excluded from the Australian income tax treatment of foreign currency. This maintains the current tax treatment of digital currencies, including the capital gains tax treatment where they are held as an investment. This measure removes uncertainty following the decision of the Government of El Salvador to adopt Bitcoin as legal tender and will be backdated to income years that include 1 July 2021.

From 1 July 2022, electric vehicles will attract concessional tax treatment. This measure will exempt battery, hydrogen fuel cell and plug-in hybrid electric cars from fringe benefits tax and import tariffs if they have a first retail price below the luxury car tax threshold for fuel-efficient cars. The car must not have been held or used before 1 July 2022 so it will not apply to a vehicle you already own.

The Government will not proceed with the measure to allow taxpayers to self-assess the effective life of intangible depreciating assets, announced in the previous Government’s 2021–22 Budget. Reversing this decision will maintain the status quo – effective lives of intangible depreciating assets will continue to be set by statute.

Families

From July 2023, Child Care Subsidy rates will lift from 85 per cent to 90 per cent for families earning less than $80,000. Subsidy rates will then taper down one percentage point for each additional $5,000 in income until it reaches zero per cent for families earning $530,000. Currently families lose eligibility for CCS once their income exceeds $350,000, so this will be attractive to those with higher incomes. The current higher CCS rates for families with multiple children aged 5 or under in child care will be maintained, with higher CCS rates to cease 26 weeks after the older child’s last session of care, or when the child turns 6 years old.

The Paid Parental Leave Scheme will become more flexible for families so that either parent is able to claim the payment and both birth parents and non-birth parents are allowed to receive the payment if they meet the eligibility criteria, to take effect from 1 July 2023. Parents will also be able to claim weeks of the payment concurrently so they can take leave at the same time. From 1 July 2024, the Government will start expanding the scheme by two additional weeks a year until it reaches a full 26 weeks from 1 July 2026. Both parents will be able to share the leave entitlement, with a proportion maintained on a “use it or lose it” basis, to encourage and facilitate both parents to access the scheme and to share the caring responsibilities more equally. Sole parents will be able to access the full 26 weeks.

Superannuation

The Government will allow more people to make downsizer contributions to their superannuation, by reducing the minimum eligibility age from 60 to 55 years of age. This measure will have effect from the start of the first quarter after Royal Assent of the enabling legislation. The downsizer contribution allows people to make a one-off post-tax contribution to their superannuation of up to $300,000 per person from the proceeds of selling their home. Importantly these contributions do not count towards non-concessional contribution caps and both members of a couple can contribute, so it can be a very attractive strategy.

At the member level, there are no major changes to superannuation, with the proposed relaxation of residency requirements for SMSFs, which was to apply from 1 July 2022, not taking effect until the income year commencing on or after the date it has been legislated.

Older Australians

To encourage older Australians into the workforce, those receiving an Age Pension or DVA Pension will receive a temporary income bank top up of $4,000. This will increase the amount pensioners can earn in 2022–23 from $7,800 to $11,800, before their pension is reduced, supporting pensioners who want to work or work more hours to do so without losing their pension.

For those over pension age, the income threshold for the Commonwealth Seniors Health Card will be increased from $61,284 to $90,000 for singles and from $98,054 to $144,000 (combined) for couples. This can offer very attractive savings so if you are not currently eligible for the health card, it is worth looking into.

The Government will also freeze social security deeming rates at their current levels for a further two years until 30 June 2024, to support older Australians who rely on income from deemed financial investments, as well as the pension, to deal with the rising cost of living. In a rising interest rate environment, this will be a welcome change for many who receive social security benefits.

In addition, the assets test exemption for principal home sale proceeds, that is, if you sell your home will be extended from 12 months to 24 months for social security purposes. The income test will be changed, to apply only the lower deeming rate, currently 0.25 per cent, to principal home sale proceeds when calculating deemed income for 24 months after the sale of the principal home.

Health Expenses

One significant change which will affect a wide range of people is the decrease in the general patient co-payment for treatments on the Pharmaceutical Benefits Scheme from $42.50 to $30.00 on 1 January 2023. This effectively reduces the out of pocket cost for PBS medicines.

Housing

While a number of housing initiatives were announced, these will be relatively targeted.

In addition to several existing measures, the Government will establish the Regional First Home Buyers Guarantee to support eligible citizens and permanent residents who have lived in a regional location for more than 12 months to purchase their first home in that location with a minimum 5 per cent deposit, with 10,000 places per year to 30 June 2026.

In addition, the Government will provide $46.2 million over 4 years from 2022–23 (and approximately $17.8 million per year ongoing) to expand access to the Defence Home Ownership Assistance Scheme to support Australian Defence Force (ADF) personnel and veterans to purchase their own home. The expansion will reduce the minimum service periods for subsidised mortgage interest payments and remove the current post separation timeframe to allow veterans to access the scheme any time after they leave the ADF.

Education

In addition to further funding of higher education, the Government will provide 480,000 fee-free Technical and Further Education (TAFE) and vocational education places in industries and regions with skills shortages. These will be provided over five years.

I would add to the above, there is a fair amount from last night’s Budget that was left unsaid. The Treasurer announced that the Budget would return to its normal timing in May 2023. To quote directly from Dr Chalmers – “It’s just the beginning of the conversation we need to have as a country – about our economic

and fiscal challenges and about the choices we need to make on what’s affordable and what’s fair.”

So watch this space in 7 months!

Hill Partners Pty Limited ABN 29 790 431 182 is an Authorised Representative of Oreana Financial Services Limited ABN 91 607 515 122, Australian Financial Services Licensee No. 482234. Registered Office Level 7, 484 St Kilda Road Melbourne, Victoria 3004 Australia General Advice Warning: https://www.oreanafinancial.com/general-advice-warning/

Privacy Policy: https://www.oreanafinancial.com/privacy-policy/

Spring 2022

Welcome to our Spring newsletter. September means it’s football finals season and hopefully the beginning of warmer weather despite the recent late winter chill.

In August, the focus was on US Federal Reserve chair Jerome Powell’s speech at the annual Jackson Hole business gathering on August 26, and he was blunt! To hose down talk of interest rate cuts in 2023 (my view was this was never going to happen), he said the Fed was focused on bringing US inflation down to 2% (from 8.5% now), even at the risk of recession. He said this will “take some time”, will likely require a “sustained period of below trend economic growth”, and households should expect “some pain” in the months ahead. The S&P500 share index promptly fell 3.4% and bond yields rose. Markets then recovered most of the falls in the next 2 weeks based on selected economic data that showed the US economy was slowing down. Earlier this week, markets fell again on the updated US CPI data. It showed headline inflation up 0.10% (!!). Markets were expecting a slight drop and hence the market sell off was severe. At the time of writing this, the ASX200 Index on Wednesday 14th September, fell 2.55% (or as the media like to report “investors lost $60bn of wealth yesterday”). This morning, the same index is up 0.64% based on the jobless rate increasing by 0.10%. I wonder if tonight’s headings will be “Investors make $15bn in 2 hours of trading!!

My point, looking at short term data and then investing based on this is fraught with danger and leads to poor investment decisions.

Economists expect the US central bank will continue lifting rates each month for the remainder of 2022. They have been largely saying this for the last 3-4 months and all the above has not changed anything.

In Australia, economic conditions are less gloomy. Australia’s trade surplus was a record $136.4 billion in 2022-23. Unemployment fell to 3.4% in July while wages growth rose to an annual rate of 2.6% in the year to June, the strongest in 8 years but well below inflation. The ANZ-Roy Morgan consumer confidence index rose slightly in September to a still depressed 85.0 points while the NAB business confidence index jumped to +6.9 points in July, well above the long-term average of +5.4 points. Half-way through the June half-year reporting season, CommSec reports ASX200 company profits increased 56% in aggregate while dividends are 6% lower on a year earlier.

The Aussie dollar fell more than one cent over the month to close around US68.5c. Aussie shares bucked the global trend, finishing steady over the month.

In short, markets are moving around at present based on daily economic data. We have to contend with;

– Higher inflation and higher interest rates

– War in Ukraine

– Supply chain issues due to Covid

– House prices falling

– Bonds and Shares selling off together (worst since 1994)

– 3rd worst financial year return for super funds in 21/22.

The good news ?

– The economy is at full employment

– Official cash rate is close to ‘normal’ lows. EG – Cash rate in August 2012 was 4% (it is currently 2.35%)

– Corporate balance sheets are strong and debt levels low

– Some Australian companies well placed to benefit from the war in Ukraine

– House prices still well above pre-COVID levels

– Many borrowers are still well ahead on repayments and there is still record amount in offset accounts

– 2nd best financial year return for super funds in 20/21

Essentially in my view we are entering a period of a return to normal. That is, companies actually need to produce cash and profit in order to justify a share price. We will likely see inflation in the 2-4% range(where we spent most of 2000 – 2013) and mortgage rate of high 4’s to high 5’s which again historically is low. What is happening at present is growth assets (shares and property) are adjusting to this.

I saw an interesting quote this morning from one the countries best performing fund managers in small cap stocks;

“I am hopeless at reading macro market moves, so I’ve given up trying. We look at companies on a rolling 4 years basis, not the next 7 days. So I don’t worry too much about the movements day-to-day. It’ll drive you crazy”

Enjoy this editions read.

How much super do I need to retire?

Working out how much you need to save for retirement is a question that keeps many pre-retirees awake at night. Recent market volatility and fluctuating superannuation balances have only added to the uncertainty.

So it’s timely that new research shows you may need less than you fear. For most people, it will certainly be less than the figure of $1 million or more that is often bandied around.

For most people, the amount you need to save will depend on how much you wish to spend in retirement to maintain your current standard of living. When Super Consumers Australia (SCA) recently set about designing retirement savings targets they started by looking at what pre-retirees aged 55 to 59 actually spend now.

Retirement savings targets

SCA estimated retirement savings targets for three levels of spending – low, medium and high – for recently retired singles and couples aged 65 to 69.

Significantly, only so-called high spending couples who want to spend at least $75,000 a year would need to save more than $1 million. A couple hoping to spend a medium-level $56,000 a year would need to save $352,000. High spending singles would need $743,000 to cover spending of $51,000 a year, and $258,000 for medium annual spending of $38,000.i

While these savings targets are based on what people actually spend, there is a buffer built in to provide confidence that your savings can weather periods of market volatility and won’t run out before you reach age 90.

They assume you own your home outright and will be eligible for the Age Pension, which is reflected in the relatively low savings targets for all but wealthier retirees.*

Retirement planning rules of thumb

The SCA research is the latest attempt at a retirement planning ‘rule of thumb’. Rules of thumb are popular shortcuts that give a best estimate of what tends to work for most people, based on practical experience and population averages.

These tend to fall into two camps:

- A target replacement rate for retirement income. This approach assumes most people want to continue the standard of living they are used to, so it takes pre-retirement income as a starting point. A target replacement range of 65-75 per cent of pre-retirement income is generally deemed appropriate for most Australians.ii

- Budget standards. This approach estimates the cost of a basket of goods and services likely to provide a given standard of living in retirement. The best-known example in Australia is the Association of Superannuation Funds of Australia (ASFA) Retirement Standard which provides ‘modest’ and ‘comfortable’ budget estimates.iii

SCA sits somewhere between the two, offering three levels of spending to ASFA’s two, based on pre-retirement spending rather than a basket of goods. Interestingly, the results are similar with ASFAs ‘comfortable’ budget falling between SCA’s medium and high targets.

ASFA estimates a single retiree will need to save $545,000 to live comfortably on annual income of $46,494 a year, while retired couples will need $640,000 to generate annual income of $65,445. This also assumes you are a homeowner and will be eligible for the Age Pension.

Limitations of shortcuts

The big unknown is how long you will live. If you’re healthy and have good genes, you might expect to live well into your 90s which may require a bigger nest egg. Luckily, it’s never too late to give your super a boost. You could:

- Salary sacrifice some of your pre-tax income or make a personal super contribution and claim a tax deduction but stay within the annual concessional contributions cap of $27,500.

- Make an after-tax super contribution of up to the annual limit of $110,000, or up to $330,000 using the bring-forward rule.

- Downsize your home and put up to $300,000 of the proceeds into your super fund.

Thanks to new rules that came into force on July 1, you may be able to add to your super up to age 75 even if you’re no longer working.

While retirement planning rules of thumb are a useful starting point, they are no substitute for a personal plan. If you would like to discuss your retirement income strategy, give us a call.

*Assumptions also include average annual inflation of 2.5% in future, which is the average rate over the past 20 years, and average annual returns net of fees and taxes of 5.6% in retirement phase and 5% in accumulation phase.

i CONSULTATIVE REPORT: Retirement Spending Levels and Savings Targets, Super Consumers Australia

ii 2020 Retirement Income Review, The Treasury

iii Association of Superannuation Funds of Australia (ASFA) Retirement Standard

Six simple ways to protect your passwords

You use passwords to access your bank accounts, social media, email and more every day.

Passwords are the keys to our online identity. That’s why protecting them is so important.

Creating a strong password is the first step to protecting yourself online. This helps reduce the risk of unauthorised access by those willing to put in a bit of guesswork.

To help stay safe online, follow these password tips.

1. Make your passwords strong

Short and simple passwords might be easy for you to remember, but unfortunately they’re also easier for cyber criminals to crack.

Strong passwords have a minimum of 10 characters and a use mix of:

- uppercase and lowercase letters

- numbers

- special characters like !, &, and *.

Use passphrases

You may like to consider using a passphrase instead of a traditional password.

Passphrases are considered more secure than regular passwords, and easier to remember too.

A passphrase is used in the same way as a password, but is a longer collection of words that is meaningful to you, but not to someone else.

For example, the passphrase ‘CloudHandWashJump7’ is 17 characters long and contains a range of different characters. This is more complex than the average password.

Having complex passwords is important to deter ‘brute force’ attacks, in which a computer program cycles through every possible combination of characters to guess a password. These automated attempts at guessing passwords are not slowed down by numbers or capital letters, but depend on how long a password is.

Depending on the systems you access, you may be limited to a defined number of characters.

2. Make passwords hard to guess

Could someone who knows you guess your passwords? For this reason, it’s best to avoid using personal information such as your children, partner or pets name, favourite football team or date of birth as your password.

When trying to hack into an online account, cyber criminals start with commonly found words and number combinations.

So it’s best to avoid using:

- dictionary words

- a keyboard pattern like qwerty

- repeated characters like zzzz

- personal information like your date of birth or pet’s name.

Security companies publish lists each year of the most common passwords exposed in data breaches. Read the list from 2020. Make sure you’re not using them, because it’s likely criminals will try these passwords first.

3. Create new, unique passwords

If you need to reset a password, don’t just change one part of it.

Instead of changing a number at the beginning or end, create something completely new you’ve never used before.

If your original exposed password had a ‘1’ at the end, an attacker would likely try ‘2’ next. That’s why it’s important to change the whole password.

Get into the practice of changing your password often, ideally every few months.

4. Don’t share passwords, ever.

Never share your password with someone, not even with someone you trust.

What about family and friends?

Regardless of whom you share it with, once you share your passwords you lose control of how it’s stored or how and when it’s used.

What if a business or company I know asks for my password?

Reputable companies won’t ask you to give them your password over the phone or via emails or SMS messages. This might be a warning sign of phishing or a scam; you can read more about phishing on our security alerts page.

NAB will never ask you for your password or PIN, either by email, SMS, over the phone or at a branch. We may ask you to provide a one-time code to verify yourself when you call our contact centre. These messages will clearly state that we will ask you for the code.

You may not be covered for fraud

One of your responsibilities as a NAB account owner and user of internet banking is to protect your password. Sharing your passwords or PINs may affect a claim for any money lost due to fraud.

5. Use different passwords for each of your online accounts

Using different passwords means that if one of your accounts is breached, criminals won’t have access to other accounts that use the same password.

Make each of your passwords for online logins unique. This will help protect you from attacks like ‘credential stuffing’.

Credential stuffing

Credential stuffing is an automated technique used by criminals. They test a user’s known username and password combinations across multiple online accounts.

As many people use the same credentials for multiple sites, it can give criminals easy access to multiple accounts.

This gives criminals an opportunity to gather more information about you, which they might use to impersonate you online to access accounts under your name.

For example, it’s not a good idea to use the same password for an online pizza delivery website and your business email. If the pizza delivery site is compromised, you don’t want someone to also have access to your business email account.

6. Store passwords safely

Writing passwords down is never recommended. You could lose them, or someone else could see them and use them.

Password management tools

There are programs and apps known as password managers that will store all your passwords in a secure vault.

A password manager only needs one strong password to access it and has extremely strong protection to make sure that only you can access it.

This means you only need to remember one password to have access to all your passwords.

Password safes can even generate and store new, complex passwords for you when you create new online accounts.

Don’t allow web browsers to store your NAB password

Some web browsers may display a pop-up message, asking whether you want the browser to remember your login details.

For the protection of your personal information, NAB recommends that you select ‘Never for this site’ if you see this message when using NAB Internet Banking.

For more information, check out the Australian Cyber Security Centre’s guide on creating secure passphrases.

Source: NAB

Reproduced with permission of National Australia Bank (‘NAB’). This article was originally published at https://www.nab.com.au/about-us/security/online-safety-tips/protect-your-passwords

National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686. The information contained in this article is intended to be of a general nature only. Any advice contained in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice on this website, NAB recommends that you consider whether it is appropriate for your circumstances.

© 2022 National Australia Bank Limited (“NAB”). All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

The trouble with intuition when investing

Knowing how your mind works can help you avoid the more obvious traps many investors fall into.

Cognitive bias has become a bit of an investing buzz phrase in recent years.

The theory is that the human brain predictably makes errors of judgment that can lead us to be emotional, short term and come to other incorrect conclusions.

Cognitive bias has been of particular interest to the investing community and long lists of biases – confirmation bias, anchoring, the recency effect and dozens of others – are now the stock-in-trade of beginner investors worldwide.

The Nobel-prize winning economist Daniel Kahneman first researched bias in human thinking, distinguishing two ways in which we think: an automatic, instinctive and almost involuntary style contrasted with effortful, considered and logical thought.

That original research has grown into an industry.

Researchers and psychologists have identified endless ways in which the human brain is prone to bias, errors and poor judgment – and the investing community has latched on.

But underlying it all is that original finding that we spontaneously seek an intuitive solution to our problems rather than taking a logical, methodical approach.

Kahneman wrote that when we are confronted with a problem – such as choosing the right chess move or selecting an investment – our desire for a quick, intuitive answer takes over.

Where we have the relevant expertise, this intuition can often be right. A chess master’s intuition when faced with a complicated game position is likely to be pretty good.

But when questions are complex and rely on incomplete information, like investing, our intuition fails us.

The very fact we find the concept of cognitive bias so appealing is simply another example of our innate desire for simple, intuitive answers.

Unfortunately, the world is complicated, and almost everything that happens in investment markets emerges from the combination of a web of unrelated, intricate and multi-faceted events.

Our bias towards simplicity is reinforced by the nightly news and the morning newspapers that persist in providing simple explanations for complex events. Each day, market movements are distilled into ‘this-caused-that’ explanations that obscure the true drivers of change.

It is our intuition that is reacting when we find ourselves excited that markets rose 100 points – and a little nervous when markets ‘wipe off’ billions. We experience these emotional reactions even though the effect on our overall wealth from either event is likely to be tiny.

Our understanding of history is similarly simple, reducing wars, recessions and pandemics into simple cause and effect stories that are easy to remember and teach.

These stories help us understand the past. But they do not help us predict the future.

This explains why investment opportunities that seemed certain at the time we made them so often go awry.

It is not bad luck or circumstances changing against us – it’s the fundamentally simplistic cause and effect model in our minds that doesn’t allow us to understand all the possible outcomes.

So how can we best use the science of cognitive bias to become better at investing?

It is certainly worth learning about the wide and growing range of cognitive biases scientists are identifying that can stand in your way of being more successful.

Knowing how your mind works can help you avoid the more obvious traps many investors fall into.

We can use the basic principles of successful investing to avoid becoming victim to our own cognitive biases. Stick to a plan and don’t react to market noise or your emotions. Stay diversified to reduce the risk of permanent loss. And ensure you do not spend too much money on unnecessary fees.

But it is also a trap to rely too heavily on the science of cognitive bias, thinking that it can provide you with the keys to investing success.

The serious research being done by psychologists has been co-opted to offer you yet another tempting short cut – and in successful investing, there is no such thing.

Source: Vanguard

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2022 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

Hill Partners Pty Limited ABN 29 790 431 182 is an Authorised Representative of Oreana Financial Services Limited ABN 91 607 515 122, Australian Financial Services Licensee No. 482234. Registered Office Level 7, 484 St Kilda Road Melbourne, Victoria 3004 Australia General Advice Warning: https://www.oreanafinancial.com/general-advice-warning/

Privacy Policy: https://www.oreanafinancial.com/privacy-policy/

Federal Budget 2022-23 Analysis

A balancing act

Billed as a Budget for families with a focus on relieving short-term cost of living pressures, Treasurer Josh Frydenberg’s fourth Budget also has one eye firmly on the federal election in May.

At the same time, the government is relying on rising commodity prices and a forecast lift in wages as unemployment heads towards a 50-year low to underpin Australia’s post-pandemic recovery.

While budget deficits and government debt will remain high for the foreseeable future, the Treasurer is confident that economic growth will more than cover the cost of servicing our debt.

The big picture

The Australian economy continues to grow faster and stronger than anticipated, but the fog of war in Ukraine is adding uncertainty to the global economic outlook. After growing by 4.2 per cent in the year to December, Australia’s economic growth is expected to slow to 3.4 per cent in 2022-23.i

Unemployment, currently at 4 per cent, is expected to fall to 3.75 per cent in the September quarter. The government is banking on a tighter labour market pushing up wages which are forecast to grow at a rate of 3.25 per cent in 2023 and 2024. Wage growth has improved over the past year but at 2.3 per cent, it still lags well behind inflation of 3.5 per cent.ii

The Treasurer forecast a budget deficit of $78 billion in 2022-23 (3.4 per cent of GDP), lower than the $88.9 billion estimate as recently as last December, before falling to $43 billion (1.6 per cent of GDP) by the end of the forward estimates in 2025-26.

Net debt is tipped to hit an eye-watering $715 billion (31 per cent of GDP) in 2022-23 before peaking at 33 per cent of GDP in June 2026. This is lower than forecast but unthinkable before the pandemic sent a wrecking ball through the global economy.

Rising commodity prices

The big improvement in the deficit has been underpinned by the stronger than expected economic recovery and soaring commodity prices for some of our major exports.

Iron ore prices have jumped about 75 per cent since last November on strong demand from China, while wheat prices have soared 68 per cent over the year and almost 5 per cent in March alone after the war in Ukraine cut global supply.iii,iv

Offsetting those exports, Australia is a net importer of oil. The price of Brent Crude oil prices have surged 73 per cent over the year, with supply shortages exacerbated by the war in Ukraine.v Australian households are paying over $2 a litre to fill their car with petrol, adding to cost of living pressures and pressure on the government to act.

With the rising cost of fuel and other essentials, this is one of the areas targeted by the Budget. The following rundown summarises the measures most likely to impact Australian households.

Cost of living relief

As expected, the Treasurer announced a temporary halving of the fuel excise for the next six months which will save motorists 22c a litre on petrol. The Treasurer estimates a family with two cars who fill up once a week could save about $30 a week, or $700 in total over six months.

Less expected was the temporary $420 one-off increase in the low-to-middle-income tax offset (LMITO). It had been speculated that LMITO would be extended for another year, but it is now set to end on June 30 as planned.

The extra $420 will boost the offset for people earning less than $126,000 from up to $1,080 previously to $1,500 this year. Couples will receive up to $3,000. The additional offset, which the government says will ease inflationary pressures for 10 million Australians, will be available when people lodge their tax returns from 1 July.

The government will also make one-off cash payments of $250 in April to six million people receiving JobSeeker, age and disability support pensions, parenting payment, youth allowance and those with a seniors’ health card.

Temporarily extending the minimum pension drawdown relief

Self-funded retirees haven’t been forgotten. The temporary halving of the minimum income drawdown requirement for superannuation pensions will be further extended, until 30 June 2023.

This will allow retirees to minimise the need to sell down assets given ongoing market volatility. It applies to account-based, transition to retirement and term allocated superannuation pensions.

More support for home buyers

A further 50,000 places a year will be made available under various government schemes to help more Australians buy a home.

This includes an additional 35,000 places for the First Home Guarantee where the government underwrites loans to first-home buyers with a deposit as low as 5 per cent. And a further 5,000 places for the Family Home Guarantee which helps single parents buy a home with as little as 2 per cent deposit.

There is also a new Regional Home Guarantee, which will provide 10,000 guarantees to allow people who have not owned a home for five years to buy a new property outside a major city with a deposit of as little as 5 per cent.

Support for parents

The government is expanding the paid parental leave scheme to give couples more flexibility to choose how they balance work and childcare.

Dad and partner pay will be rolled into Paid Parental Leave Pay to create a single scheme that gives the 180,000 new parents who access it each year, increased flexibility to choose how they will share it.

In addition, single parents will be able to take up to 20 weeks of leave, the same as couples.

Health and aged care

One of the Budget surprises in the wake of the Aged Care Royal Commission findings, was the absence of spending on additional aged care workers and wages.

Instead, $468 million will be spent on the sector with most of that ($340 million) earmarked to provide on-site pharmacy services.

The Pharmaceutical Benefits Scheme (PBS) is also set for a $2.4 billion shot in the arm over five years, adding new medicines to the list. PBS safety net thresholds will also be reduced, so patients with high demand for prescription medicines won’t have to get as many scripts.

A $547 million mental health and suicide prevention support package includes a $52 million funding boost for Lifeline.

And as winter approaches, the government will spend a further $6 billion on its COVID health response.

Jobs, skills development and small business support

As the economy and demand for skilled workers grow, the government is providing more funding for skills development with a focus on small business. It will provide a funding boost of $3.7 billion to states and territories with the potential to provide 800,000 training places.

In addition, eligible apprentices and trainees in “priority industries” will be able to access $5,000 in retention payments over two years, while their employers will also receive wage subsidies.

Small businesses with annual turnover of less than $50 million will be able to deduct a bonus 20 per cent for the cost of training their employees, so for every $100 they spend, they receive a $120 tax deduction.

Similarly, for every $100 these businesses spend to digitalise their businesses, up to an outlay of $100,000, they will receive a $120 tax deduction. This includes things such as portable payment devices, cyber security systems and subscriptions to cloud-based services.

Looking ahead

With an election less than two months away, the government will be hoping it has done enough to quell voter concerns about the rising cost of living, while safeguarding Australia’s ongoing economic recovery.

The local economy faces strong headwinds from the war in Ukraine, the cost of widespread flooding along much of the east coast and the ongoing pandemic.

Much depends on the hopes for the rise in employment and wages to offset rising inflation, and the timing and extent of interest rate rises by the Reserve Bank.

If you have any questions about any of the Budget measures, don’t hesitate to call us.

Information in this article has been sourced from the Budget Speech 2022-23 and Federal Budget support documents.

It is important to note that the policies outlined in this publication are yet to be passed as legislation and therefore may be subject to change.

i https://tradingeconomics.com/australia/gdp-growth-annual

ii https://www.abs.gov.au/media-centre/media-releases/annual-wage-growth-increases-23

iii https://tradingeconomics.com/commodity/iron-ore

iv, v https://tradingeconomics.com/commodities

Hill Partners Pty Limited ABN 29 790 431 182 is an Authorised Representative of Oreana Financial Services Limited ABN 91 607 515 122, Australian Financial Services Licensee No. 482234. Registered Office Level 7, 484 St Kilda Road Melbourne, Victoria 3004 Australia General Advice Warning: https://www.oreanafinancial.com/general-advice-warning/

Privacy Policy: https://www.oreanafinancial.com/privacy-policy/

The road ahead for shares

Trying to time investment markets is difficult if not impossible at the best of times, let alone now. The war in Ukraine, rising inflation and interest rates and an upcoming federal election have all added to market uncertainty and volatility.

At times like these investors may be tempted to retreat to the ‘’safety” of cash, but that can be costly. Not only is it difficult to time your exit, but you are also likely to miss out on any upswing that follows a dip.

Take Australian shares. Despite COVID and the recent wall of worries on global markets, Aussie shares soared 64 per cent in the two years from the pandemic low in March 2020 to the end of March 2022.i Who would have thought?

So what lies ahead for shares? The recent Federal Budget contained some clues.

The economic outlook

The Budget doesn’t only outline the government’s spending priorities, it provides a snapshot of where Treasury thinks the Australian economy is headed. While forecasts can be wide of the mark, they do influence market behaviour.

As you can see in the table below, Australia’s economic growth is expected to peak at 4.25 per cent this financial year, underpinned by strong company profits, employment growth and surging commodity prices. Our economy is growing at a faster rate than the global average of 3.75 per cent, and ahead of the US and Europe, which helps explain why Australian shares have performed so strongly.ii

However, growth is expected to taper off to 2.5 per cent by 2023-24, as key commodity prices fall from their current giddy heights by the end of September this year, turning this year’s 11% rise in our terms of trade to a 21 per cent fall in 2022-23.

Table: Australian economy (% change on previous year)

| Actual % | Forecasts % | |||

| 2020-21 | 2021-22 | 2022-23 | 2023-24 | |

| Gross domestic product (GDP) | 1.5 | 4.25 | 3.5 | 2.5 |

| Consumer prices index (CPI) | 3.8 | 4.25 | 3.0 | 2.75 |

| Wage price index | 1.7 | 2.75 | 3.25 | 3.25 |

| Unemployment | 5.1 | 4.0 | 3.75 | 3.75 |

| Terms of trade* | 10.4 | 11 | -21.25 | -8.75 |

*Key commodity prices assumed to decline from current high levels by end of September quarter 2022

Source: Treasury

Commodity prices have jumped on the back of supply chain disruptions during the pandemic and the war in Ukraine. While much depends on the situation in Ukraine, Treasury estimates that prices for iron ore, oil and coal will all drop sharply later this year.

So, what does all this mean for shares?

Share market winners and losers

Rising commodity prices have been a boon for Australia’s resources sector and demand should continue while interest rates remain low and global economies recover from their pandemic lows.

Government spending commitments in the recent Budget will also put extra cash in the pockets of households and the market sectors that depend on them. This is good news for companies in the retail sector, from supermarkets to specialty stores selling discretionary items.

Elsewhere, building supplies, construction and property development companies should benefit from the pipeline of big infrastructure projects combined with support for first home buyers and a strong property market.

Increased Budget spending on defence, and a major investment to improve regional telecommunications, should also flow through to listed companies that supply those sectors as well as the big telcos and internet providers.

However, while Budget spending is a market driver in the short to medium term there are other influences on the horizon for investors to be aware of.

Rising inflation and interest rates

With inflation on the rise in Australia and the rest of the world, central banks are beginning to lift interest rates from their historic lows. Australia’s Reserve Bank is now expected to start raising rates this year.iii

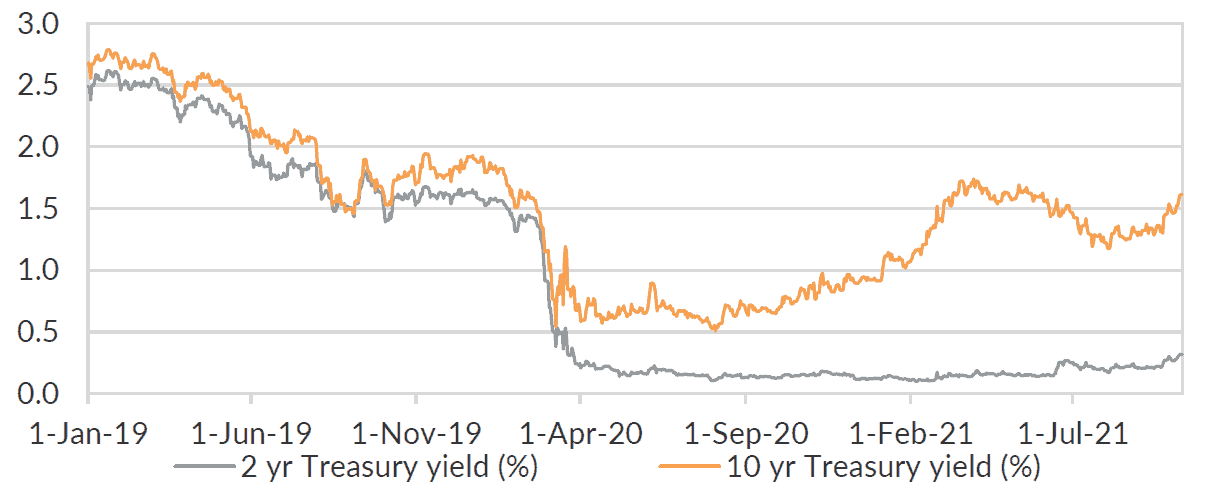

Global bond markets are already anticipating higher rates, with yields on Australian and US 10-year government bonds jumping to 2.98 per cent and 2.67 per cent respectively. However, the yield on some US shorter-term bonds temporarily rose above 2.7 per cent recently. Historically, this so-called “inverse yield curve” has indicated recession at worst, or an economic slowdown.iv

Rising inflation and interest rates can slow economic growth and put a dampener on shares. At the same time, higher interest rates are a cause for celebration for retirees and anyone who depends on income from fixed interest securities and bank deposits. But it’s not that black and white.

While rising interest rates and volatile markets generally constrain returns from shares, some sectors still tend to outperform the market. This includes the banks, because they can charge borrowers more, suppliers and retailers of staples such as food and drink, and healthcare among others.

Putting it all together

In uncertain times when markets are volatile, it’s natural for investors to be a little nervous. But history shows there are investment winners and losers at every point in the economic cycle. At times like these, the best strategy is to have a well-diversified portfolio with a focus on quality.

For share investors, this means quality businesses with stable demand for their goods or services and those able to pass on increased costs to customers.

If you would like to discuss your overall investment strategy don’t hesitate to get in touch.

ii https://budget.gov.au/2022-23/content/bp1/download/bp1_bs-2.pdf

iii https://www.finder.com.au/rba-survey-4-apr

iv https://tradingeconomics.com/united-states/government-bond-yield

Hill Partners Pty Limited ABN 29 790 431 182 is an Authorised Representative of Oreana Financial Services Limited ABN 91 607 515 122, Australian Financial Services Licensee No. 482234. Registered Office Level 7, 484 St Kilda Road Melbourne, Victoria 3004 Australia General Advice Warning: https://www.oreanafinancial.com/general-advice-warning/

Privacy Policy: https://www.oreanafinancial.com/privacy-policy/

Autumn 2022

It’s March already which marks the beginning of Autumn. While this is traditionally the season when things cool down, the economic and political scene is gearing up with the Federal Budget later this month and a federal election expected by May.

Russia’s invasion of Ukraine in late February increased volatility on global financial markets and uncertainty about the pace of global economic recovery. Notably, crude oil prices surged above $US100 a barrel, breaking the $100 mark for the first time since 2014. Rising oil prices add to inflationary pressures and could set back global economic recovery in the wake of COVID. In Australia, the price of unleaded petrol hit a record 179.1c a litre in February and is expected to go above $2.

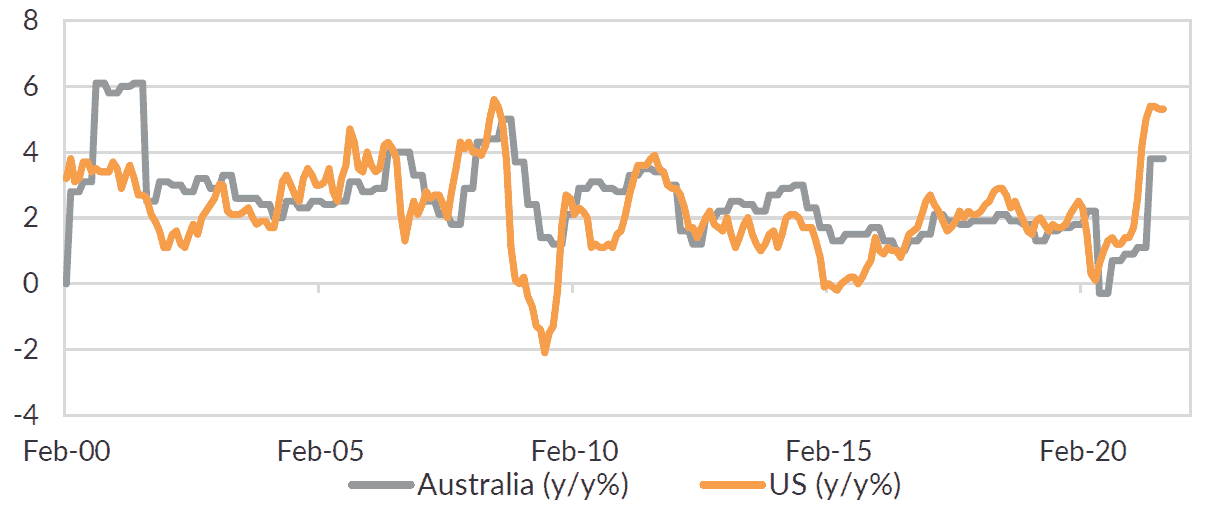

In the US, inflation hit a 40-year high of 7.5% in January. Australian inflation is a tamer 3.5% and this, along with unemployment at a 13-year low of 4.2%, is raising expectations of interest rate hikes. The Reserve Bank stated earlier in February that a rate hike in 2022 was ‘’plausible” but that it is ‘’prepared to be patient”. The Reserve is also looking for annual wage growth of 3% before it lifts rates, but with annual wages up just 2.3% in the December quarter Australian workers are going backwards after inflation. The average wage is currently around $90,917 a year.

Before the latest events in Ukraine, consumer and business confidence were improving. The ANZ-Roy Morgan consumer rating rose slightly in February to 101.8 points, while the NAB business confidence index was up 15.5 points in January to +3.5 points.

War in Ukraine has triggered a flight to safety, with bonds, gold and the US dollar rising while global shares plunged initially before rebounding but remain volatile. The Aussie dollar closed at US72.59c.

Avoid the rush: Get ready for June 30

It seems like June 30 rolls around quicker every year, so why wait until the last minute to get your finances in order?

With all the disruption and special support measures of the past two years, it’s possible your finances have changed. So it’s a good idea to ensure you’re on track for the upcoming end-of-financial-year (EOFY).

Starting early is essential to make the most of opportunities on offer when it comes to your super and tax affairs.

New limits for super contributions

Annual contribution limits for super rose this financial year, so maximising your super contributions to boost your retirement savings is even more attractive.

From 1 July 2021, most people’s annual concessional contributions cap increased to $27,500 (up from $25,000). This allows you to contribute a bit extra into your super on a before-tax basis, potentially reducing your taxable income.

If you have any unused concessional contribution amounts from previous financial years and your super balance is less than $500,000, you may be able to “carry forward” these amounts to further top up.

Another strategy is to make a personal contribution for which you claim a tax deduction. These contributions count towards your $27,500 cap and were previously available only to the self-employed. To qualify, you must notify your super fund in writing of your intention to claim and receive acknowledgement.

Non-concessional super strategies

If you have some spare cash, it may also be worth taking advantage of the higher non-concessional (after-tax) contributions cap. From 1 July 2021, the general non concessional cap increased to $110,000 annually (up from $100,000).

These contributions can help if you’ve reached your concessional contributions cap, received an inheritance, or have additional personal savings you would like to put into super. If you are aged 67 or older, however, you need to meet the requirements of the work test or work test exemption.

For those under age 67 (previously age 65) at any time during 2021-22, you may be able to use a bring-forward arrangement to make a contribution of up to $330,000 (three years x $110,000).

To take advantage of the bring-forward rule, your total super balance (TSB) must be under the relevant limit on 30 June of the previous year. Depending on your TSB, your personal contribution limit may be less than $330,000, so it’s a good idea to talk to us first.

More super things to think about

If you plan to make tax-effective super contributions through a salary sacrifice arrangement, now is a good time to discuss this with your employer, as the ATO requires documentation prior to commencement.

Another option if you’re aged 65 and over and plan to sell your home is a downsizer contribution. You can contribute up to $300,000 ($600,000 for a couple) from the proceeds without meeting the work test.

And don’t forget contributing into your low-income spouse’s super account could score you a tax offset of up to $540.

Get your SMSF shipshape

If you have your own self-managed super fund (SMSF), it’s important to check it’s in good shape for EOFY and your annual audit.

Administrative tasks such as updating minutes, lodging any transfer balance account reports (TBARs), checking the COVID relief measures (residency, rental, loan repayment and in-house assets), and undertaking the annual market valuation of fund assets should all be started now.

It’s also sensible to review your fund’s investment strategy and whether the fund’s assets remain appropriate.

Know your tax deductions

It’s also worth thinking beyond super for tax savings.

If you’ve been working from home due to COVID-19, you can use the shortcut method to claim 80 cents per hour worked for your running expenses. But make sure you can substantiate your claim.

You also need supporting documents to claim work-related expenses such as car, travel, clothing and self-education. Check whether you qualify for other common expense deductions such as tools, equipment, union fees, the cost of managing your tax affairs, charity donations and income protection premiums.

Review your investment portfolio

After a year of strong investment market performance, now is also a good time to review your investments outside super. Benchmark your portfolio’s performance and check whether any assets need to be sold or purchased to rebalance in line with your strategy.

You might also consider realising any investment losses, as these can be offset against capital gains you made during the year.

If you would like to discuss EOFY strategies and super contributions, call our office.

How to calm those market jitters

It’s been a rocky start to the year on world markets but that doesn’t mean you should hit the panic button. Staying the course is generally the best course, but that’s easier said than done when there’s a big market fall.

In January markets plunged some 10 per cent but then staged a recovery. That volatile start may well be an indication of how the year pans out.i

The key reasons for this volatility are fear of inflation, the prospect of rising interest rates and pressure on corporate profits. Add to that ongoing concern surrounding COVID-19 and the conflict between Russia and Ukraine, and it is hardly surprising markets are jittery.

But fear and the inevitable corrections in share prices that come with it are all a normal part of market action.

Downward pressures

Rising interest rates and inflation traditionally lead to downward pressure on shares as the improved returns from fixed interest investments start to make them look more attractive. However, it’s worth noting that inflation in Australia is nowhere near the levels in the US where inflation is at a 40-year high of 7.5 per cent. In fact, the Reserve Bank forecasts underlying inflation to grow to just 3.25 per cent in 2022 before dropping to 2.75 per cent next year.ii

Reserve Bank Governor Philip Lowe concedes interest rates may start to rise this year, with many market analysts looking at August. Even so, he doesn’t believe rates will climb higher than 1.5 to 2 per cent. After all, with the size of mortgages growing in line with rising property prices and high household debt to income levels, rates would not have to rise much to have an impact on household finances and spending.iii

Even with rate hikes on the cards, yields on deposits are likely to remain under 1 per cent for the foreseeable future compared with a grossed-up return (after including franking credits) from share dividends of about 5 per cent.iv

The old adage goes that it’s “time in” the market that counts, not “timing” the market. So if you rush to sell stocks because you fear they may fall further, you risk not only turning a paper loss into a real one, but you also risk missing the rebound in prices later on.

Over time, short-term losses tend to iron out. Growth assets such as shares offer higher returns in the long run with higher risk of volatility along the way. The important thing is to have an investment strategy that allows you to sleep at night and stay the course.

Chance to review

A downturn in the market can also present an opportunity to review your portfolio and make sure that it truly reflects your risk profile. Years of bullish performances on sharemarkets may have encouraged some people to take more risks than their profile would normally dictate.

After many years of strong market returns, it’s possible that your portfolio mix is no longer aligned with your investment strategy. You may also want to make sure you are sufficiently diversified across the asset classes to put yourself in the best position for current and future market conditions.

A recent study found that retirees generally have a low tolerance for losses in their retirement savings. Retirees often favour conservative investments to avoid experiencing downturns, but this means they may lose out on strong returns and capital growth when the market rebounds.

Think long term

Over the long term, shares tend to outperform all other asset classes. And even when share prices fall, you are still earning dividends from those shares. Indeed, the lower the price, the higher the yield on your share investments. And it is also worth noting that with Australia’s dividend imputation system, there are also tax advantages with share investments.

For long-term investors, rather than sell your shares in a kneejerk reaction, it might be worthwhile considering buying stocks at lower prices. This allows you to take advantage of dollar cost averaging, by lowering the average price you pay for a particular company’s shares.

Investments are generally for the long term, especially when it comes to your super. Chopping and changing investments in response to short-term market movements is unlikely to deliver the end results you initially planned.

If the current turbulence in world markets has unsettled you, call us to discuss your investment strategy and whether it still reflects your risk profile and long-term objectives.

i https://tradingeconomics.com/stocks

ii https://www.abc.net.au/news/2022-02-02/rba-governor-philip-lowe-press-club-address/100798394

Protect your identity

If your personal information falls into the wrong hands, it can be used to steal your identity.

If you think your identity has been stolen, report it to your local police and your bank, and change your passwords.

Signs of identity theft

If your identity has been stolen, you may not realise for some time. These are some signs to look out for:

- Unusual bills or charges that you don’t recognise appear on your bank statement.

- Mail that you’re expecting doesn’t arrive.

- You get calls following up about products and services that you’ve never used.

- Strange emails appear in your inbox.

Act fast if your identity is stolen

What to do if you think your identity has been stolen.

Report it to the police

Report it to your local police department. Ask for the police report number so you can give it to your bank.

Contact your bank

Contact your bank so they can block the account. This will stop a scammer from accessing your money. You may also need to cancel any credit or debit cards linked to your accounts.

Change your passwords

If someone has stolen your identity, they may know your passwords. Change your passwords straight away. Think about all of your online accounts, including social media and other bank accounts.

Report it to the relevant websites

If you think someone has hacked into your online accounts, report it to the relevant websites.

Alert family and friends

If someone has taken over your social media accounts or your email address, alert your family and friends. Tell them to block the account.

Report it to the ACCC

The ACCC’s Scamwatch collects data about scams in Australia. Your report helps Scamwatch create scam alerts to warn the community.

Contact IDCARE

IDCARE is a free service that will work with you to develop a plan to limit the damage of identity theft.

Protect yourself from identify fraud

Simple steps you can take to avoid identity theft.

Secure your mail

Put a lock on your street mailbox so that people can’t steal your mail.

Shred your documents

Letters from your bank, super fund and employer can all contain personal details scammers can use to steal your identity. Shred these kinds of letters before you throw them out.

Use public computers with caution

If you use a public computer, for example, at a library, make sure you clear your internet history and log out of your accounts.

Be careful on social media