Federal Budget 2020

Attached is a good summary of the Budget handed down recently. On the whole we would comment that it will go a long way to helping Australia work its way out of the pandemic. It encourages workers by lowering taxes and encourages businesses to employ and spend. Yes, it will result in a lot of debt but what we need now is incentives to grow our economy. The Reserve Bank are also doing there bit by lowering the cost of borrowing for both Governements, Institutions and individuals.

Looking forward whilst the path is still not certain, the building blocks are there for a solid 2021,2022.

Shares over the long term – what to expect?

A quick 4 minute read looking at how shares perform over short periods of time and how this changes over the longer term. As the author points out;

“Volatility is the cost of participating in the long-term benefits of share investing”.

Remember, wealth is accumulated over the long term and this is even more true when investing in share based investments.

Some lessons on why you should stay the course.

The attached is well worth reading in our view. It is good article by Morningstar looking at what investors do when looking at short term negative events, assuming it will last for years to come and them trying to trade around this.

Market Update – can we look longer term vs just the now?

Some comments from myself and what I am seeing, reading and in talking to others and jumbled in with commentary from funds managers we are talking to at present;

Volatility is at extreme levels, in many places more so than in 2008. This is as much a function of impaired liquidity as anything else. I saw a comment from a fund manager on Friday which rings very true – “markets stop panicking when policymakers start” … and that process has begun. Policymakers are ramping up big policy responses but, so far the communication has been painfully bad and there is no global co-ordination. Both need to improve before markets can stabilise and liquidity improve.”

Policymakers are now finally communicating a ‘whatever it takes’ narrative, providing more policy details and co-ordinating better. The essential first steps toward normalising financial market function are now happening. Some examples:

- US Federal Reserve cut its official cash rate to zero and announced $700m of bond purchases (i.e. QE). This is in addition to Friday’s announcement of up to $5 trillion of cumulative liquidity injections. They learned the lesson from 2008 … act aggressively and fast.

- On Friday, Germany announced up to EUR550bn of funds to be made available to for companies to survive the economic disruption. Germany’s finance minister said “This is the bazooka … We’re using it to do what is necessary. We’ll check later to see if we need additional smaller weapons.”

- Canada’s central bank and govt. held a joint press conference to simultaneously announce rate cuts and fiscal stimulus.

- The French President is calling for G-7 leaders’ summit today. Overnight they had a meeting in which it was agreed a whatever it take approach is required and fast. Markets were hoping got definitive’ s but too early for that. I would expect it to happen in a few days though.

- The US President Trump acted more presidential on Friday, announcing aggressive measures around targeted help to certain sectors and evidence of co-operation with democrats. THIS IS A GOOD THING.

- I was talking to clients yesterday and commented that I felt that it wouldn’t surprise me to see PM Morrison announce further measures following last weeks. I read overnight this is in the works

- I also hear that the RBA is close to announcing quantitative easing (QE).

In addition we have seen in the last 2 days;

“Australia’s securities regulator has issued directions to a number of large equity market participants, requiring them to limit the number of trades executed each day until further notice, it says in statement Monday. Directions require those firms to reduce their number of executed trades by up to 25% from the levels executed on Friday March 13. This action will require high-volume participants and their clients to actively manage their volumes”

– Bloomberg News, 16th March

This morning I read that on Friday UniSuper (an $85bn dollar super fund) has stopped lending its shares out to hedge funds and the like to combat short seller in the market (that is traders selling shares they don’t own in the hope of buying them back cheaper). I expect other large Industry Super Funds to announce the same measures.

The above 2 measures are designed to stop the large falls in markets. I would not be surprised if ASIC banned short selling in full for a period of time (they did this in 2008 and 2009).

Weekend and Monday headlines were dominated by more lockdowns in EU (Spain, France) + rising infection numbers in most places. However, in the midst of all the panic a nascent narrative is emerging of the worst being over in two of the earliest and hardest hit countries (China and South Korea). For example, on Saturday S. Korea reported more recoveries from the coronavirus than new infections on Saturday for the second day in a row as targeted containment based on large scale testing seems to be working. The same appears to be happening in China (with usual caveats on data reliability). If this continues, we’re getting a preview of a positive outlook once the peak of the epidemiological curve has passed.

A commend below from one of our fixed income managers;

Why is it relevant?

– The arrival of the policy cavalry means we’re now on the path to resuming normal market functioning and we can’t even begin to think about a sustained recovery in risk assets without this happening.

As we saw in 2008, interest rate markets need to stabilise and function properly before everything else can. This is because rate markets are the plumbing of the financial system, they are the risk-free benchmark from which everything else priced and they need to function properly before liquidity can return everywhere else.

– Due to impaired liquidity and market functioning, prices everywhere are no longer about fundamentals or valuation. They are being driven by forced risk reduction, margin calls, deleveraging etc. A direct result of this is a breakdown of conventional pricing relationships. For example, last week the MSCI World Index fell -12.5% and global govt. bonds fell -3.5% (Barclays Global Govt. Bond Index) ie bonds did not hedge equities.

To help the system function through this institutions like the RBA and US Fed as outlined above are pumping huge amounts into the financial system.

All of the above will work when markets feel the worst is close OR as I alluded to above, we see signs there is light at the end of the tunnel with what other countries have experienced.

Finally – I heard a very seasoned fund manager comment that the current share market is like you OWN a shop full or products (read shares) and at present you are willing to sell them for anything that anyone is prepared to offer. You know what you own is of high quality and that in less than 12 months you could probably sell them for 30% more but you simply don’t care. All rationale thought has gone. This is what investors are faced with at present.

I personally don’t know when the market will stop falling but I believe we are close to where the selling will stop as all the above actions by Central banks, Governments, Regulators etc…. once Covid_19 stops spreading or appears to be getting under control, we will be left with still low unemployment (it will rise but it should be short term), interest rates close to zero and measures in place to support the economy in getting back on its feet. These are the conditions that provide very solid equity market returns.

As always, please feel free to reach out if you have any questions.

I have attached a note from Shane Oliver. Again, it tries to put things in context and perspective as the mass media are doing a very good job of spreading rampant fear. On the drive into work this morning I heard Australia’s Chief Medical Officer repeat numerous times during an interview that 80% of us will be absolutely fine and are highly likely to experience no symptoms at all. The risk is the small percentage of the population it will affect and the serious consequences of that on them. The various measures being put in place are designed to limit the damage to this group of people and provide the medical system with the support it needs. Sounds all reasonable. The radio host thanks the Dr and then says “really scary stuff, the chief medical officer of Aust. says there are going to be some of us that won’t see this through!!!”

Market Update – Coronavirus and Oil

Given the large and sudden deterioration in share markets globally in the last week, I wanted to put some perspective on things. The very sharp falls in the last 2 days are a result of the continued march of Covid_19 and Russia and the OPEC producing oil nations not being able to agree to curb production.

However, a large reason for the falls yesterday and overnight was also due to computers (read algorithms) trading the market and those with Margin Loans being forced to sell as the value of their portfolio’s fall close to what they borrowed. So it wasn’t (for the most part) investors. To put some numbers around what happened in last few weeks;

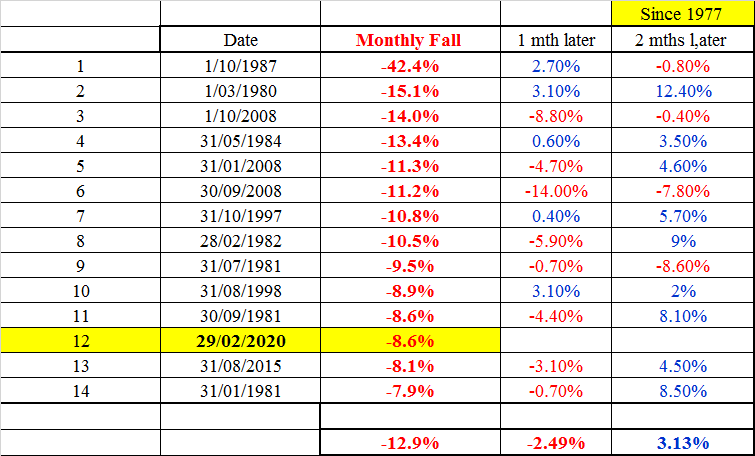

The February fall of -8.6% in the All Ords was the 12 biggest in the last 43 years.

- In the last 43 years we have had 13 previous times where All Ords dropped -7.9% or more in a single month.

- Now 6 of these 13 times it was down again the following month (and 3 times both the 2 following months).

- But the fall the first month was -12.9% – but the following month we saw the All Ords on average down another -2.49%. The reason being that markets re-tests its lows & after such a big fall as the panic sellers continue to sell the rallies.

- Then the 2nd month – after the lows are held – it’s been higher 9 times or 70% of the time, with an average gain of +3.13%.

Source Coppo report (Bell Potter)

What this does show is that prices fall and prices rise. The issue is the timing is impossible to predict. If Russia & Saudi both came to an agreement, the oil price would recover a lot of lost ground & all these problems would disappear, as quickly as they emerged. So markets will hope that Russia takes the Saudi’s aggressive oil war manoeuvres on the weekend & comes back to the table this week.

The below is a good article (US based) that reinforces we are INVESTORS, not traders. At Murphy Hill we don’t believe in buying the 3 letter ASX code but actual businesses. So we are looking at profitability, what they produce or provide, debt levels, quality of management and the like. Corona Virus and the Oil price are short term issues for us to contend with. In our view, they are not long term issues.

As the CIO of AustralianSuper said this morning (I am summarising a long article);

“Investors need to ask themselves three questions – How big the coronavirus could become?, What will the economic impact be? and How will the market react to those economic ramifications?” To the first question, NO one knows at this stage. To the Second question, the OECD say that globally it will result in a 1.5% drop in global growth (yes that’s correct ,1.5%), although several countries like Japan, South Korea could fall into recession. To the third AustralianSuper are of the view that the effect on global growth will be sharp but short. It is clearly going to push global growth lower. If it’s a severe but temporary phenomenon, the impact on profits won’t be large and of course reserve banks and Governments are going to do everything they can to stimulate economies.

Lastly, please keep in mind when you get your information from the media, be careful what you are reading. I saw an article in the Financial Review last night quoting Bill Evens (Chief Economist for Westpac since 1991) with a headline of Chief Economist says Australia heading for Recession. So you click on the article and he says (and I quote);

“On a quarterly basis we expect the economy will contract in both the first and second quarters by 0.3 per cent and 0.3 per cent respectively to be followed by a rebound of 1.4 per cent and 0.8 per cent respectively in the third and fourth quarters,” Westpac chief economist Bill Evans wrote.

“That growth profile constitutes a technical recession but given the expected recovery in the second half of the year it is much more realistic to characterise the situation as a ‘major disruption’ to growth rather than the style of recession that Australia has experienced in the past.”

The article also quotes CommSec chief economist Craig James predicting petrol prices could also drop dramatically.

“The ready-reckoner is that every US$1 a barrel fall in the oil price leads to a 1.0 cent fall at the petrol bowser. Provided the Aussie dollar is reasonably stable, motorists may be able to look forward to filling up for near $1 a litre,” he wrote in a research note.

Fuel prices in Australia’s capital cities on Sunday ranged from an average of $1.19 a litre in Adelaide to $1.536 in Hobart, according to Motormouth.com.au.

In Sydney, petrol was selling for $1.248, while it cost an average of $1.239 in Melbourne.

This is a good thing for an economy, especially one in the middle of the biggest Infrastructure build we have ever gone through, not to mention the re-build following the bush fires. This means it is cheaper to fill up for you and I but also cheaper for heavy machinery, trucks distributing goods, planes and the like.

To finish off, the best piece of advice I can give at this juncture is to ask yourself what your financial goals and objectives are in the next few years and focus on these. It also helps to STOP updating what your portfolio value constantly. In times like these, we know it’s going to be down. However, it’s only crystalized once you sell. If I told you your house was down in value last year by some 7-10% (which it was), would you have sold? No. You would say, not important as I am a long term investor in property and it will eventually come back to value (which it has!). The same logic needs to be applied to share based investments.

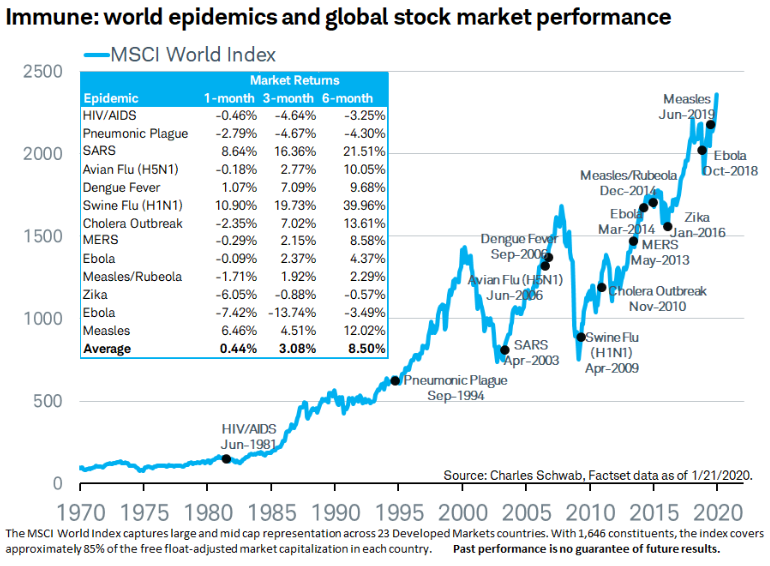

Corona Virus and investment implications

The current volatility around world markets has been well published and I am sure we have all felt moments of uneasiness during this time. Cashing up your investments may seem like the logical solution, however before making that decision we felt it would be good to show you what happened in past pandemics on world markets. Looking at the data below we can see that in the majority of cases markets rebounded quite strongly once the epidemic had ended.

It is important during these times to remember why we invest and to acknowledge that volatility is a trade-off for generating returns above the rate of cash over the longer term.

It is important to point out that the past does not guarantee how future events will play out and ultimately, the severity of the virus will dictate the market’s reaction.

At the bottom we have also attached a link to a good article by Shane Oliver (Chief Economist and Head of Investment Strategy at AMP Capital). He puts some context around current events. In time like the present, negative news takes centre stage and it compounds in the short term. A good example is our apparent need to have enough toilet paper for 1 year at the present time. Most people when asked why you just bought 80 toilet rolls reply, “because everyone else is”!

As Warren Buffett has repeated for over 50 years (and I am reading at present a lot of professional investors, fund managers and private equity investors making the same comments) – “Be fearful when others are greedy. Be greedy when others are fearful,”

Why Market Timing Doesn’t Work

Quite often here at Murphy Hill we get some very interesting articles that have been collated by Jim Parker, Vice President of DFA Australia Limited. Today’s is one worth reading in the current climate, with an introduction by Jim.

“Market timing is a strategy where investors quit the market to try to avoid losses before they happen and buy back in at or near the bottom to secure the best gains. This implies that you can have the high returns in stocks without taking on the risk. But at this article explains, that idea is a fantasy”. https://medium.com/makingofamillionaire/why-market-timing-doesnt-work-5a546ebb4515

10 Key Messages during volatile times

Thoughts from Fidelity investments

Markets are subject to periods of volatility which can undermine confidence. Here are 10 key messages to help you better understand.