Climbing the wall of worry

By Portfolio Advisory Service | 12 Oct 2021 | Market Insights, Market Outlook

Evergrande. The US debt ceiling. Federal Reserve QE tapering. Supply shortages. Oil prices. Stagflation. High valuations.

The list goes on. Global investors face a wall of worry that has many questioning the prospects for further equity market gains. Recent market volatility has been challenging. That has made it difficult to look through the headlines to the strong fundamentals beyond.

We expect global growth will remain solid in in the near-term. And that leaves us optimistic on equity market returns over the medium-term.

Low growth, high inflation? We don’t think so

In many developed economies, inflation is above the central bank targets. Supply chain disruptions have pushed prices higher for many goods and services. Wage growth is normalising following the pandemic. Oil prices are almost 60% higher year-to-date.

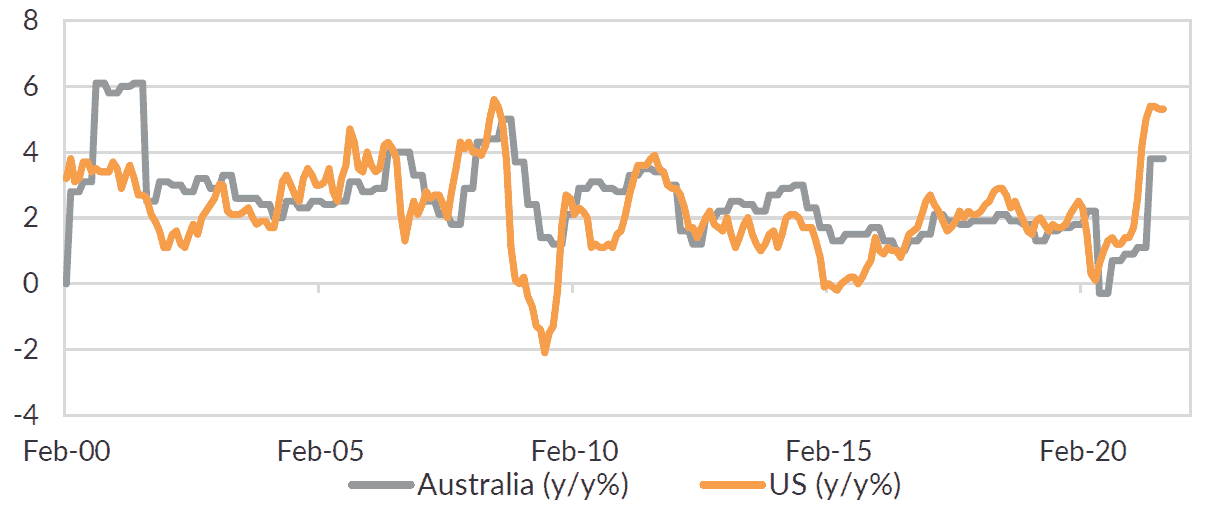

Figure 1: Inflation is elevated in the US and Australia relative to recent history

Higher inflation will at least partially be transitory. Many of the impacts will begin to normalise over the coming 12 months. But some of it will be more persistent. We expect wages growth to revert to higher levels than immediately pre-pandemic. This will coincide with productivity increases. The outcome is wage growth that will benefit households without being overly inflationary.

At the same time, growth is slowing. Growth surged after Covid19-related lockdowns. The reopening pushed growth to unrealistically high levels from very low bases. The normalisation process is occurring now. We should expect growth to move back towards more historically normal levels through 2022 and 2023.

Higher bond yields, higher equities

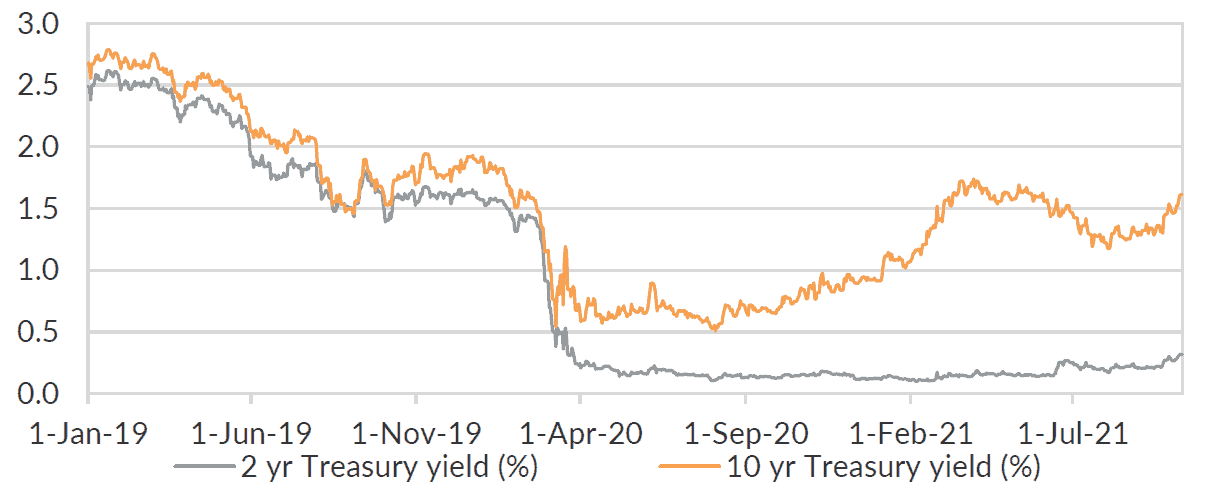

The economic growth and inflationary outlook all but ensures that the US Federal Reserve will begin reducing its asset purchase program this year. Other central banks have already started tapering. And rate hikes are on the cards in some developed economies over the next three to four months.

We expect that will lead to higher government bond yields. The US Treasury 10-year yield, for example, is currently around 1.6%. We have previously forecast that yield to rise to around 2% by end-2021 and to reach as high as 3% over the coming 18 months.

Figure 2: US Treasury yields have moved higher, and we expect have further to go

That doesn’t need to spell negative outcomes for global equities. Higher bond yields in this case reflects reasonable growth outcomes, inflation normalising to central bank targets, and central banks beginning to move policy rates higher gradually. This remains a positive environment for corporate revenues and earnings growth. We also expect that as rates do drift higher, many corporates will take the opportunity to issue debt and buyback equities, adding support to equities over the medium-term.

Stay invested

September was one of the worst months in recent years for a typical balanced portfolio. Equites and bond prices fell. Those types of market movements can prompt reactionary moves within portfolios. We recommend holding the course. In some markets, we suggest adding to risk. Despite the near-term volatility, we expect global equities to continue to climb a wall of worry and deliver strong medium-term risk adjusted returns.