Corona Virus and investment implications

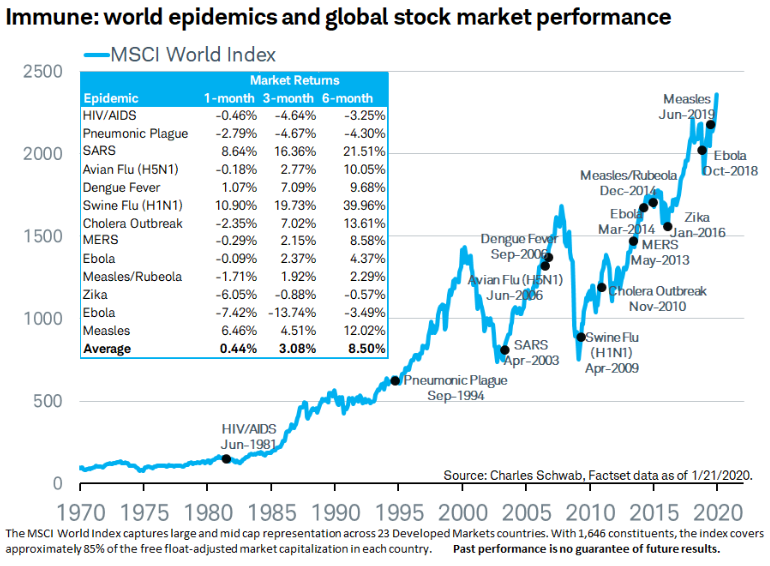

The current volatility around world markets has been well published and I am sure we have all felt moments of uneasiness during this time. Cashing up your investments may seem like the logical solution, however before making that decision we felt it would be good to show you what happened in past pandemics on world markets. Looking at the data below we can see that in the majority of cases markets rebounded quite strongly once the epidemic had ended.

It is important during these times to remember why we invest and to acknowledge that volatility is a trade-off for generating returns above the rate of cash over the longer term.

It is important to point out that the past does not guarantee how future events will play out and ultimately, the severity of the virus will dictate the market’s reaction.

At the bottom we have also attached a link to a good article by Shane Oliver (Chief Economist and Head of Investment Strategy at AMP Capital). He puts some context around current events. In time like the present, negative news takes centre stage and it compounds in the short term. A good example is our apparent need to have enough toilet paper for 1 year at the present time. Most people when asked why you just bought 80 toilet rolls reply, “because everyone else is”!

As Warren Buffett has repeated for over 50 years (and I am reading at present a lot of professional investors, fund managers and private equity investors making the same comments) – “Be fearful when others are greedy. Be greedy when others are fearful,”